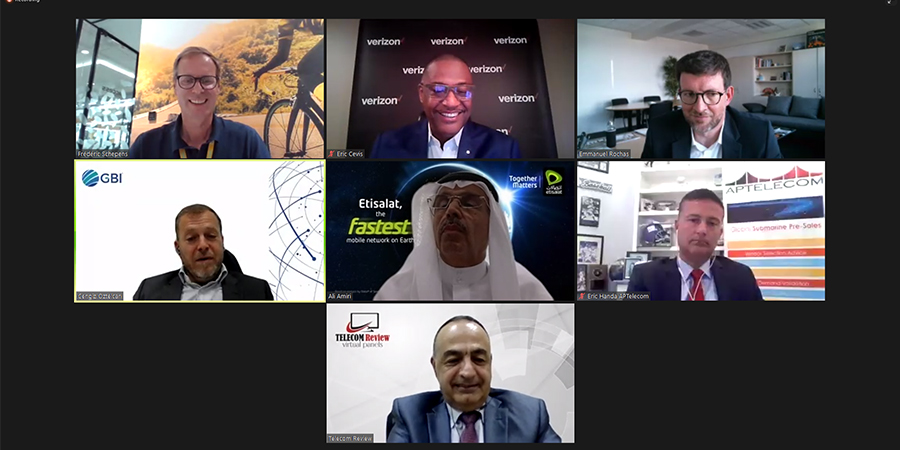

Telecom Review hosted an insightful virtual panel titled ‘Digitizing the capacity industry’ on October 5, 2021. Crucial points relating to the wholesale and capacity sector were addressed by a panel of industry experts, comprising of Cengiz Oztelcan, CEO, GBI; Ali Amiri, group chief carrier and wholesale officer, Etisalat Group; Frédéric Schepens, CEO, MTN Global Connect; Emmanuel Rochas, CEO, Orange International Carriers; Eric Cevis, President, Verizon Partner Solutions; Eric Handa, CEO & Co-Founder, AP Telecom.

The session was chaired by Toni Eid, CEO, Trace Media and founder, Telecom Review.

During the discussions, the following 2 questions among others were tackled.

Q1. What does the future hold for the wholesale industry in terms of data traffic increase and datacenters?

Eric Handa said that they were fairly bullish on the future of growth but not on the future of margin or price erosion. “The current cost structure that many wholesale operators have is not conducive to servicing the reality of price erosion. All the operators that are on the call globally will potentially be victims of consolidation or consolidators. The reality is that the decrease in pricing, the increase in competition, with the ability for enterprise buyers to be like the wholesale customer, which is happening, is going to continue,” he said. “There are a lot of challenges; however, the lean, the means and the agile will do well. But they need to be able to support the reality of the new cost structure,” he stressed. He felt that setting up online portals for self-service operations for upgrades and turning capacity up and down would be important to keep the connectivity going. “You cannot serve as a profitable business selling $2000 for 10 or 100 gig circuit a month. It is just not possible. We're going to have to scale automation and technology and that's the key determinant,” he stressed from an advisory standpoint.

Taking on the question, Frederic Schepens said that from an MTN perspective they saw significant growth from the strategy that they had laid out. “From a GlobalConnect perspective, we grew 50% in terms of revenue, compared to last year, but there's still a long way to go. We are also moving towards fiber setups and structurally separating fiber assets from mobile operators towards MTN GlobalConnect where we have a proprietary fiber network of 85,000 kilometers, growing to 135,000 km, which we’ll open up as an open-access model so that everybody can benefit in the field of digitization and data growth. We are driving to keep the traffic on the continent rather than relaying it back and forth to the US or Europe. Platform-as-service, network-as-service is supercritical to maintain the growth of the industry,” he added.

Adding to the conversation, Ali Amiri said, “Our data centers have grown in terms of location and size to cater for the growth.” He cited the example of Africa1 cable which is expected to be ready by the fourth quarter of 2023, to deliver the latency required for future services. He felt that in terms of capacity, both subsea and terrestrial infrastructures were of utmost importance.

Q2. Beyond what has been said previously what will bring back growth in the telco industry?’

Tackling the question, Emmanuel Rochas said, “Global data traffic is exploding. The 90% of the traffic we see today has been created in the past 2 years and this is going to continue with 5G, IoT, etc. However, growth will not be created by traffic alone because, at the end of the day, customers are ready to pay for more services and not data. The value will be on the services that we deliver on this connectivity. On-demand digital experience is something that will create value for customers,” “To deliver this type of experience to our customers we've started a range of service such as IP transit, EDPL which is now on-demand, with APIs, including the local loop on our Orange countries. But we still have a world of opportunities in front of us and, in particular, coming from the virtualization of networks functions. We have started a major transformation project on our international networks to give a unique infrastructure for the B2B and carrier markets to have a common infrastructure and build a layer of the virtualized services functions to be delivered on-demand and open in self-service for our customers, and this is the future where we will be able to create new value on top of our legacy activity, which is bringing connectivity to the world.”

Agreeing with his co-panelist’s words, Eric Cevis said, “I continue to believe that our products and services will build on top of the network and we're going to be a network-as-a-service provider. More and more applications are moving to wireless - 5G LTE standpoint, fixed wireless access, wireless backup services. And above the networks, we talk about services like video conferencing activities like BlueJeans and IoT, where there are billions of dollars of opportunities. As we move forward in the fourth industrial revolution and take advantage of the use cases that we can get from an LTE and a wireless standpoint and will continue to move up the stack by offering more useful applications and expanding data center presence with higher bandwidth capabilities.”

Cengiz Oztelcan said that satellite connectivity companies such as OneWeb, Starlink, SpaceX, etc are poised to make a strong entry into the wholesale and capacity market and they will overcome the two biggest issues of latency and high prices as their technologies mature to compete with us in terms of reliability and latency and price point will start converging. In terms of growth, he said, “Telco industry already has growth, we're going to continue to grow and what has fundamentally fueled that growth is globalization around the world. This globalization took a little bit of a pause over the pandemic, resulting in increased data consumption in terms of video streaming and other services, but once the globalization efforts start picking up where they left off, that's going to continue to drive the telco industry on a global level.”

Highlighting an important point on growth, Eric Handa said, “Selling access only is a losing proposition. What we see from a very challenging point of view is that more competition is continuing to come in and self-cannibalization in organizations taking place. There is a need to diversify from the core of just selling access.” He said telcos need to take aggressive and immediate action to partner and diversify their revenue streams and reiterated that selling access only in a dumb pipe in three years or five years without an appropriate cost structure could be a recipe for disaster.

In his final words, Frederic Schepens said, “Future growth is changing. Today, we are seeing more activity than pre-Covid periods, which is quite interesting. It’s true that it's a different activity, perhaps a little bit less of the traditional setup, but, we need to capitalize on it and be very adamant at executing and how we can do that together.” He added that strategic partnerships are the way forward for the industry's growth.