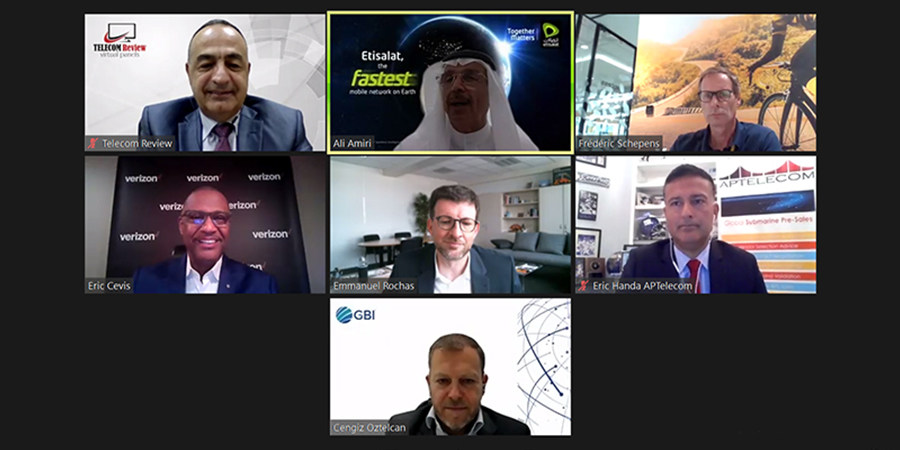

Telecom Review, the Middle East’s leading ICT media platform, held a virtual panel titled ‘Digitizing the capacity industry’ on October 5, discussing topics such as the latest developments in the wholesale industry, connecting the world through digital infrastructure, on-demand services: data, cloud, connectivity, reimagining data centers to meet the needs of the new era, and what does the future hold for the wholesale industry in terms of data traffic increase?

The session chaired by Toni Eid, CEO, Trace Media and founder, Telecom Review, kick started in a cordial environment among all speakers present, of who we name: Ali Amiri, Chief Carrier & Wholesale Officer, Etisalat Group; Cengiz Oztelcan, CEO, GBI; Emmanuel Rochas, CEO, Orange International Carriers; Eric Cevis, President, Verizon Partner Solutions; Eric Handa, CEO & Co-Founder, AP Telecom; Frédéric Schepens, CEO, MTN Global Connect.

In the first topic discussed, esteemed speaker reflected on how did digital acceleration and consumer behavior change on the long run impact the wholesale and capacity industry with over 18 months of pandemic.

Ali Amiri was the first to answer this question saying that indeed, customer behavior has changed after 18 months as everyone today is much more involved in the online world, learning to use new platforms which as Microsoft Teams or Zoom, which weren’t used as regularly before. In addition, Amiri shared a document showing the change in people's behavior, in terms of buying, stating that during these 18 months, pre-Covid-2019, only 13.6% of global purchases were made online, whereas post-Covid-19, online purchases grew to 19.5%, recording a 43% growth in just two years.

Cevis noted that in order to keep their connectivity going, they had to increase their network capacity, adding that Verizon also invested in platforms like BlueJeans which allowed a lot of distance learning. “All the investments made paid off because we had been on this customer digital transformation journey, for several years now,” Cevis added.

Schepens stressed that the pandemic was important as it shows again that telecoms and the services offered are essential. “If we weren’t there as an industry to fuel and help overcome this situation, it probably would have been a totally different world. […] We at MTN GlobalConnect and our partners, did a great job in building a reliable world.”

Handa presented his viewpoint saying that “wholesale will change post-Covid. We’re already starting to see that change maybe not in the Middle East yet, but in the GCC.”

Second, Eid tackled with the speakers the following: how important is it for operators to become a one-stop-shop that provides digital experiences for its customers and what are the expectations from the market and customers. On this note, Rochas stated that, “Everything will become digital, and this is exactly what we are living today […] If we want to provide to our customers what they expect, which is quality over capacity, more reliability, more simplicity more responsiveness, we need to digitize.”

The stop and shop approach will emerge the industry, and will enable the customers to focus on their business and have at their disposal a proposal which does not oblige them to manage a number of different providers and services. So this approach is really a requirement in the industry and needs to be built together by interconnecting different approaches and offers that will answer all the customer needs.

Schepens also commented on this subject, saying, “We started by consolidating our activities as a one-stop-shop. I still remember negotiating many year ago on individual roaming agreements with many companies, and today, we’ve now consolidated all of that. This indeed will help streamline, digitize, and simplify a lot of this end-to-end capability.” He added, “We took a strategic decision to build state-of-the-art PaaS enablements, thus offering new way of interoperability and driving more efficiency. What we are doing now is completely converting the capacity business where we are driving it as a zero-touch network with top-notch end-to-end capabilities.”

Ali Amiri, chief carrier & wholesale officer, Etisalat Group commented that, “The experiences that people had are somehow quite advanced compared to some telcos and I think that's really important for customer service so that they feel that when they approach any telco, they are offered a one-stop-shop: they can order online, they know where their orders are, they know the prices, etc. We have to be really on the top of it.”

For Cevis, he stated his opinion saying “We’re operators in this one-stop-shop environment today, and as operators, clearly we have to make scenario planning to make sure we're caring for those needs today. As Verizon, we put a lot of investment in roadmaps relative to make customer experience become a reality and provide customers a superior digital experience.”

Third, a question was raised about the right regulatory and industry policies that need to be established to encourage (digital) infrastructure investment. Eid’s quick comment within the discussion of regulations, connectivity, partnerships, etc., is that many are saying that “data is the new oil, but for regulators — it’s selling spectrum.”

Cengiz Oztelcan, CEO of GBI, said that upon working closely with regulators, these authorities are, in general, quite conservative and not open to digitalization efforts or improvements. Some prefer to ‘wait and see’ from neighboring countries or watch other regulators which results in a very tricky and long process.

For Eric Handa, CEO & co-founder of APTelecom, regulators are in a challenging position as they are dealing with ‘animals’ such as telcos that are traditionally buying access as well as OTT players. The former is being offered at the highest price possible while the latter wants the lowest price possible. Handa added that “a lot of regulators, in general, lack industry experience. So, I think, training and education are critical to work with them and get them up to speed of what this glorified utility — telecoms — face.”

Citing rural broadband as an example, Eric Cevis, president of Verizon Partner Solutions, said that with regulatory bodies partnering with telcos, they must make sure that everyone has the bandwidth they need across the globe. “Those types of regulatory partnerships will continue to help in advance the things that we're doing going forward.”

Agreeing to a one-stop-shop approach, Rochas is fully convinced that there will be no single one-stop-shop in the market tomorrow or in five years’ time. Instead, a number of one-stop-shops must work together on the same basis. “We need to continue to coordinate on the way we implement this digitalization and transformation so that we can go fast enough and avoid creating different customer journeys that do not go hand in hand.”

Then, Eid addressed a question about the on-demand services that will represent a genuine breakthrough for enterprises that need fully flexible connectivity solutions to which industry leaders from MTN GlobalConnect, Etisalat, GBI, and Verizon Partner Solutions responded by sharing their current initiatives that provide what their customers demand now and in the future.

Within MTN, they are not only serving enterprises but also the rest of the world. Frédéric Schepens, CEO of MTN GlobalConnect, said, “we usually receive a lot of requests from Eric [North America], Emmanuel [Europe] and from the rest of the world in order to make sure that we’ve got reliable services on the African continent.”

As per Schepens, they have increased one-stop-shop enablement as well as data center services. “What is interesting is that the moment you start continuing the automation and the digitization programs, it has a strong play to continue customizing the future needs of enterprise services.”

Ali Amiri, group chief carrier and wholesale officer of Etisalat Group, pointed out that self-service provisioning and online portals are quite important. “You have to have this self-service provisioning with a good extent of control within the customer,” he said. In this way, customers will appreciate the change.

In addition, Cengiz Oztelcan, CEO of GBI, said that as businesses (and their needs) increase complexity, a ‘seesaw’ reaction can be seen. “As those things get more complex, they want simplicity in operations.” Enterprises may not even want to hear the word connectivity and other aspects that have to do with it, “they want to just take 100% SLA, by default, in a very simple way.”

Eric Cevis, president of Verizon Partner Solutions highlighted in this context the network-as-a-service (NaaS) as their company continues to leverage network slicing; provide flexibility; optimize enterprise networks, optics, and CAPEX spending; minimize waste; and stop technology obsolescence.

Moreover, Eid moved on to another question, urging the speakers to reflect on the future of the wholesale industry in terms of data traffic increase and datacenters.

Handa said that they were fairly bullish on the future of growth but not on the future of margin or price erosion. “The current cost structure that many wholesale operators have is not conducive to servicing the reality of price erosion. […]The reality is that the decrease in pricing, the increase in competition, with the ability for enterprise buyers to be like the wholesale customer, which is happening, is going to continue.”

Taking on the question, Frederic Schepens said that from an MTN perspective they saw significant growth from the strategy that they had laid out. “From a GlobalConnect perspective, we grew 50% in terms of revenue, compared to last year, but there's still a long way to go. We are also moving towards fiber setups and structurally separating fiber assets from mobile operators towards MTN GlobalConnect where we have a proprietary fiber network of 85,000 kilometers, growing to 135,000 km, which we’ll open up as an open-access model so that everybody can benefit in the field of digitization and data growth. We are driving to keep the traffic on the continent rather than relaying it back and forth to the US or Europe. Platform-as-service, network-as-service is supercritical to maintain the growth of the industry,” he added.

Adding to the conversation, Ali Amiri said, “Our data centers have grown in terms of location and size to cater for the growth.” He cited the example of Africa1 cable which is expected to be ready by the fourth quarter of 2023, to deliver the latency required for future services. He felt that in terms of capacity both subsea and terrestrial infrastructures were of utmost importance.

Following these, Eid as well addressed a last question to reflect on what will bring back growth in the telco industry.

Rochas said, “Global data traffic is exploding. The 90% of the traffic we see today has been created in the past 2 years and this is going to continue with 5G, IoT, etc. However, growth will not be created by traffic alone because, at the end of the day, customers are ready to pay for more services and not data. The value will be on the services that we deliver on this connectivity. On-demand digital experience is something that will create value for customers,”

Cevis said, “I continue to believe that our products and services will build on top of the network and we're going to be a network-as-a-service provider. More and more applications are moving to wireless - 5G LTE standpoint, fixed wireless access, wireless backup services. And above the networks, we talk about services like video conferencing activities like the BlueJeans and IoT, where there are billions of dollars of opportunities.

Oztelcan said that satellite connectivity companies such as OneWeb, Starlink, SpaceX, etc are poised to make a strong entry into the wholesale and capacity market and they will overcome the two biggest issues of latency and high prices as their technologies mature to compete with us in terms of reliability and latency and price point will start converging. In terms of growth, he said, “Telco industry already has growth, we're going to continue to grow and what has fundamentally fueled that growth is globalization around the world. This globalization took a little bit of a pause over the pandemic, resulting in increased data consumption in terms of video streaming and other services, but once the globalization efforts start picking up where they left off, that's going to continue to drive the telco industry on a global level.”

Handa pointed out that telcos need to take aggressive and immediate action to partner and diversify their revenue streams and reiterated that selling access only in a dumb pipe in three years or five years without an appropriate cost structure could be a recipe for disaster.

In his final words, Frederic Schepens said, “Future growth is changing. Today, we are seeing more activity than pre-Covid periods, which is quite interesting. It’s true that it's a different activity, perhaps a little bit less of the traditional setup, but, we need to capitalize on it and be very adamant at executing and how we can do that together.” He added that strategic partnerships are the way forward for the industry's growth.

To conclude the panel, a Q&A session took place which allowed the audience to raise questions of their own to the esteemed speakers as well as answer a poll that was launched by Telecom Review.