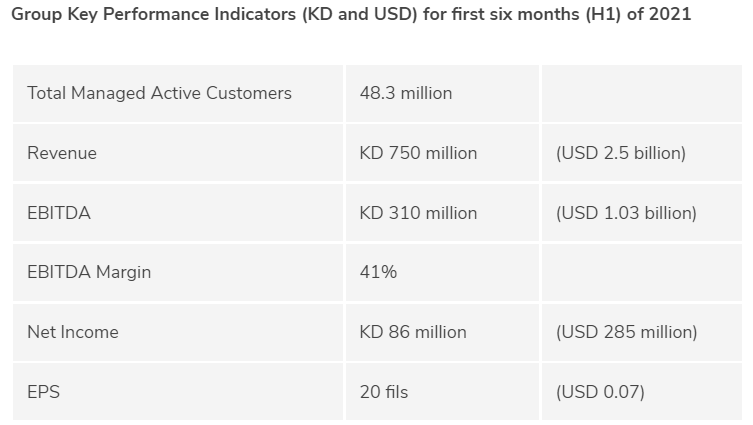

For the first six months of 2021, Zain Group generated a net income of KD 86 million (USD 285 million), up 5% Y-o-Y, reflecting earnings per share of 20 fils (USD 0.07). During the second quarter alone, the net income amounted to KD 41 million (USD 138 million), up 17% Y-o-Y.

As shown in the table above, Zain Group generated consolidated revenue of KD 750 million (USD 2.5 billion) during H1 2021, a decrease of 3% Y-o-Y while EBITDA for the period reached KD 310 million (USD 1.03 billion), down 6% Y-o-Y, reflecting an EBITDA margin of 41%.

On a separate note, in Q2 2021, the company’s consolidated revenue is worth KD 369 million (USD 1.2 billion), remaining relatively stable compared to the prior period.

Interim dividend of 10 fils per share for H1 2021

During the Extraordinary General Assembly held in June 2021, the Board of Directors' recommendation to distribute interim dividends, quarterly or semi-annually has been approved. Following this, a board meeting held on July 14 recommends an interim dividend of 10 fils per share for the first six months of 2021 as part of the minimum 33 fils annual dividend policy.

Commenting on H1 2021 results, chairman of the board of directors of Zain Group, Mr. Ahmed Al Tahous said, “The Board’s key focus during these challenging times has been to support management in its endeavors to be future-ready to fully exploit the next phase of growth in driving shareholder value. We remain focused on providing meaningful connectivity and minimizing the impact of the pandemic on society by implementing digitalization initiatives to better serve communities, businesses, and governments. I would like to thank all the government ministries and regulatory authorities across our markets for their wisdom and understanding of the emerging industry dynamics and support of the telecom sector at large.”

Mr. Bader Nasser Al-Kharafi, Zain vice-chairman and group CEO commented, “The Board’s recommendation to pay a half-year dividend of 10 fils per share (as part of the 33 fils) is a result of our strong balance sheet and the solid operational performance attained by the Group in the year to date. This interim dividend recommendation is a first in Zain’s history and follows the approvals received during the recent Extraordinary General Assembly, and reaffirms the three-year minimum 33 fils dividend policy commitments we made in 2019.”

Heavy investments on 4G, FTTH, and 5G networks

Throughout the first six months of 2021, Zain Group invested over USD 491 million in CAPEX reflecting 20% of revenue, predominantly in the expansion of fiber-to-the-home (FTTH) infrastructure; spectrum fees; 4G upgrades, and new network sites across its markets, as well as 5G rollouts in Kuwait, Saudi Arabia, and Bahrain.

Al-Kharafi continued, “The robust growth witnessed during Q2 2021 reaffirms the success of the ‘4Sight’ strategy and digital transformation set forth by the Board and executive management to invest heavily and focus on monetizing our 4G, FTTH, and 5G networks while seeking new business verticals and revenue streams. Our excellent performance is even more satisfying when one considers the unavoidable currency devaluations in Iraq and Sudan, which had a considerable impact on the financials.”

In detail, Zain Iraq’s H1 2021 revenue reached USD 376 million, EBITDA amounted to USD 145 million, and the net profit reached USD 24 million for the period. The operator’s customer base in the country increased as well by 7% to reach 16.1 million customers.

On the other hand, Zain Sudan generated revenue of USD 160 million, with EBITDA amounting to USD 77 million, and a doubled net income of USD 41 million, compared to USD 15 million last year. Data revenue grew by 4% representing 28% of total revenue, while the operator’s customer base grew 8% to reach 17 million.

“Operationally, most of our markets recorded growth in Q2 as compared to the same period a year earlier. The healthy growth in Kuwait was powered by its incomparable 5G network that sees the operator capturing the largest market share in the country. Similarly, quality networks were instrumental in the robust profit growth in Iraq, Jordan, Sudan, and Bahrain, while in Saudi Arabia the operator continues to receive international accolades for the reach, speed, and quality of its 5G network,” the Zain Group CEO added.

Performance of key markets

“Moreover, it’s rewarding that for the first time in its history, Zain KSA achieved positive Retained Earnings after reporting its profitability for the 12th consecutive quarter and extinguishing all accumulated losses in accordance with its capital restructuring strategy, and we look forward to the operator exploiting the enormous potential of the Saudi telecom market and entering a new era of growth. Congratulations to the Zain KSA board and management team for this decisive milestone,” said Al-Kharafi.

For H1 2021, the operator generated revenue of SAR 3.8 billion (USD 1 billion), with EBITDA amounting to SAR 1.5 billion (USD 401 million) in Saudi Arabia. The net income for the period also reached SAR 83 million (USD 22 million). Having the Kingdom’s largest 5G network covering 50 cities, data revenue represented 50% of total revenue and customers served stood at 7.4 million, a 4% increase.

Being the flagship operation of Zain Group, Kuwait’s customer base serves 2.4 million and displayed its most profitable operation in H1 2021 with a revenue growth of 4% to reach USD 515 million (KD 155 million). The operator also recorded a net income of USD 123 million (KD 37 million) as it continues to grow its 5G mobile and broadband customers and resulting revenue.

Strong growth in wholesale and B2B

When it comes to Zain’s Wholesale business, Al-Kharafi noted, “We have recently revamped our wholesale carrier company, ‘Zain Global Services’, consolidating and providing it the resources to open new revenue streams and manage the capacity, voice, messaging, and roaming businesses across Zain’s operating companies. Zain Global Services will ultimately evolve to become a truly regional carrier and the single interface for all of Zain’s operating company requirements, as well as for other international carriers having requirements within the region.”

It is worth noting that their B2B revenue has grown an impressive 16% over the year, landing several lucrative corporate accounts in key markets.

“Over recent years, Zain has been evolving to become a fully integrated service provider and has been focusing on enterprise segments for additional synergies and growth. Given that the wholesale industry has at its core the transformation of the infrastructure enabling global connectivity, Zain considers the development of its wholesale business as a key area to the telco’s overall transformation.”