Telecom Review successfully presented its latest webinar titled "5G Deployment in North Africa,” which gathered industry experts to discuss the adoption rates and potential coverage, along with opportunities and challenges related to spectrum issues.

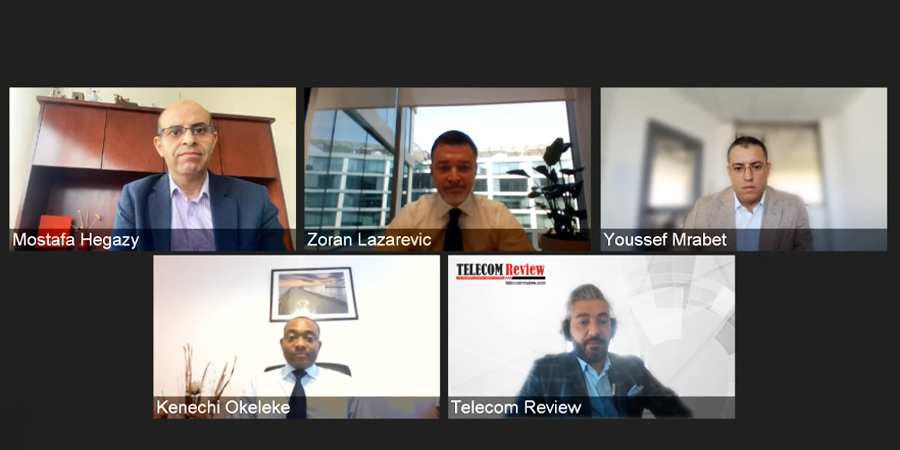

Issam Eid, COO of Telecom Review Africa, was the moderator of the panel, which featured executive panelists, including Kenechi Okeleke, director, GSMA Intelligence; Mostafa Hegazy, director, IT & network innovation and strategy, Orange Egypt; Zoran Lazarević, chief technology officer for market area Middle East & Africa, Ericsson; and Youssef Mrabet, CTO for North and West Africa, Nokia.

In his opening note, Kenechi Okeleke shared insights from various GSMA reports on the implementation of 5G in North Africa. He provided a worldwide perspective on 5G commercialization, revealing that by June 2023, 238 operators in 94 markets globally had launched 5G operations, with 106 of them in 52 markets also introducing fixed wireless access connections.

Notably, 254 operators in 110 markets had conducted 750 trials on 5G, with companies like Nokia and Ericsson leading in supporting these trials. Okeleke emphasized that the mid-band frequency range (1-7 GHz) was the driving force behind global 5G deployments. Comparatively, North Africa was lagging behind in 5G commercialization and spectrum allocation when compared with other regions on the continent. He highlighted that North Africa's readiness for 5G was indicated by high levels of smartphone and 4G adoption, as well as significant investment by operators in network modernization. Okeleke stressed the urgent need for spectrum allocation in North Africa and projected that commercial 5G services could be available by 2024, potentially resulting in over 130 million 5G connections in the region by 2030, equivalent to 41% of total mobile connections in North Africa. He concluded that the adoption of 5G could contribute $6.6 billion to the North African economy by 2030.

New Solutions and Services Coming

The first question addressed the current status of 5G deployment and shared updates on commercial testing progress. Hegazy stated that nearly all operators in North Africa have initiated testing and field trials for 5G. In Egypt, they have received regulatory clearance for 5G field testing and believe they are prepared from a network standpoint. Discussions between operators and regulatory authorities are underway regarding the allocation of more spectrum, particularly in the 3.5 GHz band. In recent years, Egyptian operators have secured extensions for the 4G service spectrum in the 2.6 GHz band. Hegazy suggested that this band could be utilized in the early stages of 5G deployment. He also mentioned that the initial transition of traffic from 4G to 5G is anticipated to be modest due to the availability of 5G-capable handsets in the region's smartphone market.

Mrabet highlighted that many countries have already started announcing their 5G roadmaps, and various levels of demonstrations, tests and trials have been conducted since 2019. He emphasized the need for modernizing radio access networks to accommodate the increased demand and capacity brought about by 5G. Mrabet noted that network evolution is a constant process across generations and emphasized the significance of frequency allocation by regulatory bodies.

Lazarević emphasized that with proper frequency allocation, a mutually beneficial outcome can be achieved. This not only affects how telcos serve African customers with high-performing networks but also influences the cost-effectiveness of network construction. Spectrum allocation is a crucial aspect of 5G deployment in North Africa.

Unlocking 5G FWA Opportunities

Next up was a question about how 5G might affect the GDP growth of North African countries. Mrabet pointed out that there's been a lot of research in this area. He highlighted extensive studies on 5G's impact. PwC projects a global GDP impact of $1.3 trillion by 2030 due to 5G. While stronger, more modern economies are expected to benefit the most, Mrabet believes that North Africa holds a particularly crucial opportunity.

He emphasized the potential of 5G fixed wireless access (FWA) in bridging the digital divide, especially in rural areas where it complements fiber-optic buildouts. This technology plays a pivotal role in North Africa's push towards 5G and digitalization, as exemplified by national plans in countries like Morocco, Tunisia and Egypt.

Hegazy also said that there are opportunities in private networks, citing examples in sectors like marine harbors, trading and logistics in Egypt where 5G could streamline operations and reduce resource expenditure.

Lazarević emphasized the importance of home broadband in North Africa, noting that FWA is a more effective solution compared to extensive fiber-optic networks. He anticipated a substantial surge in FWA adoption in the region by 2024. For Ericsson, their focus on 5G use cases in Africa follows a step-by-step approach, with FWA taking center stage. They plan to explore more complex applications like private networks, gaming and augmented reality in due course.

Okeleke expressed confidence that North Africa will embrace 5G as new solutions emerge, citing the $6.6 billion estimated economic impact. He believes 5G will significantly boost productivity across various sectors and improve government service delivery.

The Sustainability Factor in 5G

The discussion shifted to the impact of 5G deployment on energy consumption for service providers. Lazarević emphasized that 5G represents a significant leap in energy efficiency and that while previous generations (1G, 2G, 3G and 4G) improved network performance, they also led to unsustainable increases in energy consumption. With 5G's standardized processes and design, there is potential for a reduction in energy usage. Lazarević drew attention to an Ericsson report highlighting that ICT contributes to 1.4% of CO2 emissions and that 5G could potentially cut emissions from other industries by up to 15%.

Mrabet echoed this sentiment, emphasizing the integral role of digitalization in improving energy consumption. He advocated for a swift shift towards 5G and phasing out legacy networks to make the former more appealing for operators and environmentally efficient.

Okeleke added that using renewable energy sources like solar and wind to power telecom networks is a cost-effective way forward. He emphasized the need for cheaper energy sources to efficiently deploy 5G, especially with its densification and increased energy consumption.

Hegazy acknowledged that transitioning to 5G will initially lead to higher energy consumption due to coexisting with older generations. He emphasized the long-term energy efficiency of 5G but stressed the importance of mitigating early-phase consumption increases. Exploring renewable energy sources is crucial to achieving these green targets.

Maximizing 5G Benefits

Regarding 5G deployment, the industry leaders provided valuable insights into effective strategies for optimizing investments and improving user experiences. Lazarević emphasized the critical role of meticulous planning in achieving efficiency and success. Many operators are opting for non-standalone (NSA) deployment as a starting point, as highlighted by Lazarević, who acknowledged its strategic advantages.

Mrabet further supported this approach, underscoring the popularity of NSA deployment due to its network simplicity and its potential for experimenting with and maximizing 5G capabilities. Importantly, he emphasized that investments in NSA are fully compatible with future standalone 5G deployments, ensuring a seamless transition.

Okeleke pointed out the increasing awareness of 5G among consumers and predicted that this awareness will drive interest and adoption. He also noted that consumers may not experience significant price increases during the transition to 5G, enhancing its attractiveness.

Hegazy emphasized the critical importance of monetization in the 5G landscape, acknowledging that it is a pressing concern for many operators. These insights from industry experts serve as valuable guidance for vendors and operators seeking to navigate the complexities of 5G deployment while effectively monetizing investments and delivering superior user experiences.

Optimizing 5G Spectrum Allocation in North Africa

The final question addressed the acquisition of new spectrum that operators should secure for 5G deployment. Lazarević said that now is the pivotal moment for 5G implementation in North Africa. He highlighted the effectiveness of deploying 5G within the existing spectrum, although with potentially limited impact compared to the use of a dedicated new spectrum. The allocation of fresh spectrum is crucial for realizing significant strides in 5G. He stressed that regulators play a crucial role in securing additional spectrum, as many carriers require significant bandwidth. Effective allocation is vital to maximizing usability and return on investment. Lazarević advocated for avoiding the reuse of existing spectrum to prevent degradation.

Mrabet underlined the critical importance of allocating sufficient bandwidth for operators. He noted that 100 MHz has become the standard for effective equipment utilization. Adequate capacity through spectrum allocation is vital for fixed wireless access, which serves fixed subscribers. Mrabet also highlighted the need for technology neutrality in spectrum allocation.

Hegazy stressed the need for at least 50 MHz of spectrum to ensure a satisfactory 5G experience, particularly for 4G subscribers. He suggested gradual progress in spectrum allocation to meet growing demand and achieve the full benefits of 5G.

Poll Questions

Moderator Issam Eid then presented three poll questions to the audience, with panelists providing their insights on each.

The first question asked viewers about their familiarity with the current availability and progress of 5G in North African countries. The results showed that 75% of the audience indicated "in progress," while 25% felt it hadn't yet begun. The second question focused on comparing 5G deployment in North Africa to its concurrent global progress. The responses were as follows: 75% voted "lagging behind," and 25% chose "limited data."

The third question explored the likelihood of North African countries offering widespread access to 5G networks soon. In response, 25% of the audience believed it to be "highly probable," while 75% thought it "seems unlikely in the near future."